WeFunder is an equity crowdfunding service that connects startup businesses with investors online.

The platform uses a provision in the 2012 Jumpstart Our Businesses (JOBS) Act which allows non-accredited investors to purchase equity in early-stage private companies.

In this article, we’ll be going through:

- The Founding of WeFunder

- The Concept Behind WeFunder

- The Most Successful WeFunder Campaigns in history

- Additional Resources Surrounding Equity Crowdfunding

Let’s get started!

Founding of WeFunder

The WeFunder equity crowdfunding platform was founded in 2012 by Nick Tommarello, Mike Norman, and Greg Belote. Y Combinator was also a key incubator during the platform’s development and launch phases.

WeFunder itself was the first startup to raise funding on Wefunder, gathering more than $10 million from 1,000 investors.

Since the platform’s inception:

- 1,449 startups have been successfully funded on the platform

- $261 million have been invested in various startups

- 16,743 jobs have been created as a result

- Companies have gone on to raise $5 billion after WeFunder

According to the company’s 2021 Impact Report, the platform aims to fund 20,000 more founders by 2029 as part of their “movement to fix capitalism.”

The Concept Behind WeFunder

On the WeFunder platform, non-accredited investors are given the opportunity to invest as little as $100 in startups that they believe in.

In exchange for their investment, investors are given equity in the company’s future profits.

WeFunder bills itself as “Kickstarter for Investing.” However, unlike Kickstarter or Indiegogo, supporters do not receive a reward (usually in the form of a product or insider access) for their money.

Instead, backers invest in a business with no guarantee of a return. If the business an investor chooses to support does well, they have a chance to make big money for getting in on the ground floor. But if it fails (which most startups do), the investor loses all of their money.

Like any investment strategy, there is an element of risk. And in the case of WeFunder, investment is even riskier. Investors should plan to buy and hold for a long time (years) to see returns.

However, there have been many successful startups that have gone on to acquire huge economic gains that have paid impressive dividends.

The Most Successful WeFunder Campaigns in History

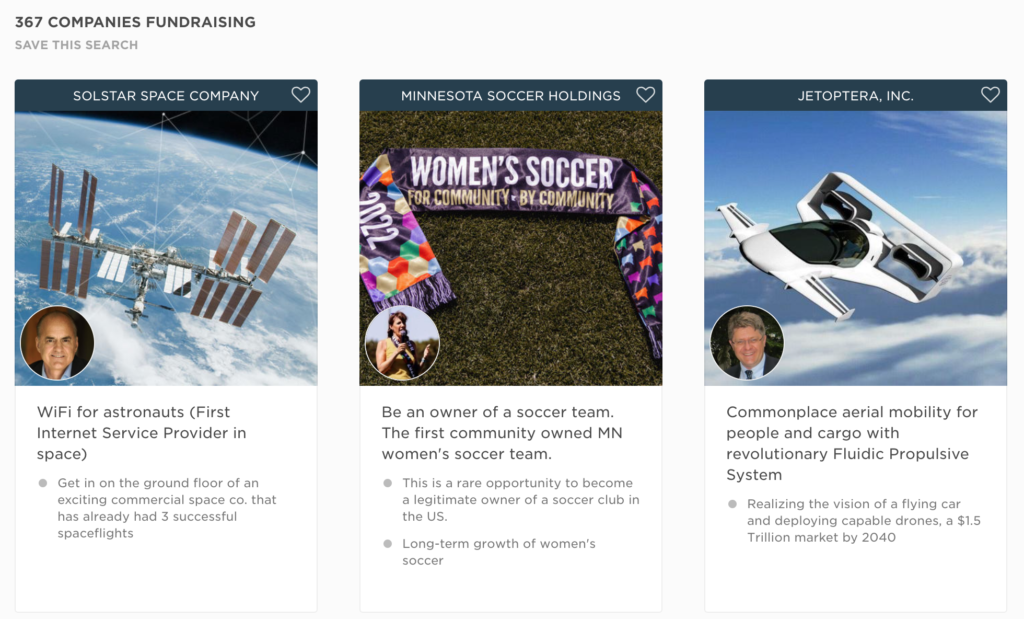

Since WeFunder’s inception, there have been some impressive success stories. The platform has funded 4 startups that are now worth over $1 billion, and 12 startups worth over $100 million.

It can be difficult to classify what makes a WeFunder campaign ‘most successful,’ as funding on the platform doesn’t necessarily indicate future success. In many cases, it’s just a starting off point.

Nevertheless, here are some notable companies that got their start with WeFunder:

Zenefits

Year: 2013

Type: HR Software

Raised on WeFunder: $50,000

Raised after WeFunder: $583 million

Current Valuation (2020): $4 billion

Meow Wolf

Year: 2017

Type: Art Collective

Raised on WeFunder: $1.32 million

Raised After WeFunder: $213 million

Everipedia

Year: 2016

Type: BlockChain

Raised on WeFunder: $129,878

Raised After WeFunder: $30 million

Goldbelly

Year: 2013

Type: Food Service

Raised on WeFunder: $61,000

Raised After WeFunder: $33 million

VBit DC

Year: 2021

Type: Bitcoin Mining

Raised on WeFunder: $2.1 million

Raised After WeFunder: Active on WeFunder at time of writing

Additional Resources Surrounding Equity Crowdfunding

To learn more about equity crowdfunding or find advice for running your own equity crowdfunding campaign, visit these resources:

- What is Equity Crowdfunding?

- 6 Equity Crowdfuning Pros and Cons

- Equity Crowdfunding Statistics in 2020

- 5 Tips for a Killer Equity Crowdfunding Campaign

- How Equity Crowdfunding Works (Video)

- What is Equity Crowdfunding? (Video)

Here at CrowdCrux, we’re dedicated to leading the charge into the equity crowdfunding era. To stay up-to-date, make sure to:

- Subscribe to the once-weekly newsletter

- Check out the Crowdfunding Demystified Podcast

- Subscribe to the Youtube Channel

- Find the book: Equity Crowdfunding Explained

Ready to get started on your own campaign? Book a coaching call with our founder Salvador Briggman. We’ve run equity crowdfunding campaigns before, and we might be available to go to work for you.

We hope that this article has been informative as you discover all the possibilities of WeFunder and equity crowdfunding. The future of startup investing is extremely bright!