Ever since I learned about the new French law that allows startup companies to raise up to $1.4 million (€1 million) per Kickstarter-like crowdfunding campaign, I’ve been curious just how much growth French crowdfunding platforms have experienced.

If you’re interested, I’ve included a snippet of the TechCrunch article explaining the new law.

“Previously, equity crowdfunding was limited to $140,000 (€100,000) and your company couldn’t be an SAS (the French equivalent of an LLC). And if you raised more than $140,000, you had to work with a lawyer to produce hundreds of pages of legal documents. With the new law, as long as you raise less than $1.4 million in an equity crowdfunding round, you only have to file a short document of 3 or 4 pages.

There are a couple of restrictions. When it comes to Kickstarter-style crowdfunding, individuals won’t be able to invest more than $1,400 in a campaign (€1,000). Until now, many French companies chose to create an LLC to launch a Kickstarter campaign in dollars. It might change with the new rules…”

Thankfully, Ulule and KissKissBankBank have some awesome platform data and it was easy to pull together the brief chart below.

Judging from the data above, it seems like the platforms are pretty well-matched and there is no clearly defined “market winner.” Both French crowdfunding websites are all-or-nothing platforms for creative projects and charge a 5% platform fee (along with payment processing fees).

One interesting difference is that Ulule allows creators to either “set a budget target, or a number of objects / items to pre-sell. In the case of a subscription (or pre-sale), the project owner will have to set a price and the minimum number of preorders necessary to produce his product / idea.”

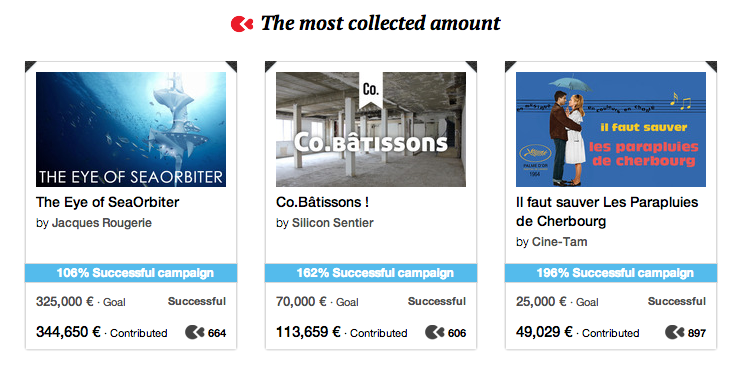

I’ve included more in-depth statics below for each of the platforms.

Ulule

KissKissBankBank

Conclusion

For both of the companies, presented projects and funds collected seem to be nearing a hockey stick exponential growth curve. I really like the transparency of both companies and think some of the insights like “You have a 96% chance of success when your campaign reaches 41% of its goal” are incredibly valuable for creators.

If you’ve used either platform, I’d love to hear what you think and whether or not you were happy with the experience. Like others, I’m eager to see the impact that equity crowdfunding will have on the way startups raise funds.

Note: I haven’t included MyMajorCompany in this blog post, but I intend to update the article once I hear back from the staff.