Indiegogo recently announced that they are partnering with MicroVentures to offer a new equity crowdfunding service.

This has been a long awaited announcement. There were rumors for some time that the company would eventually enter the equity crowdfunding space.

Now, as a non-accredited everyday investor, you can invest in startup companies through their new platform. You can also list your own company in their marketplace and raise funds under a Title III offering.

In this blog post, I’ll be sharing a few of the things that you should know about Indiegogo’s new equity crowdfunding site before you dive in.

1. All Transactions Are Done Through MicroVentures

MicroVentures is one of the top FINRA registered broker-dealers in the equity crowdfunding space. At the time of writing, they’ve raised over $100 million for companies on their platform from accredited investors. Also, over 95% of the campaigns on their platform have been funded.

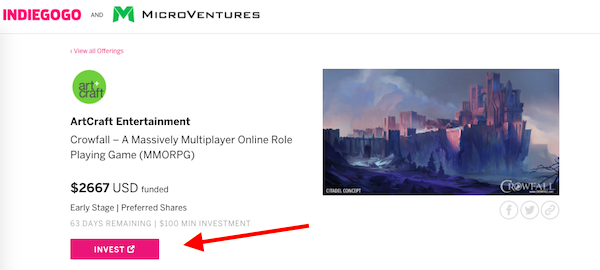

Right now, when you click “invest” on Indiegogo Equity, you’ll be taken to the accompanying company listing on the MicroVentures website.

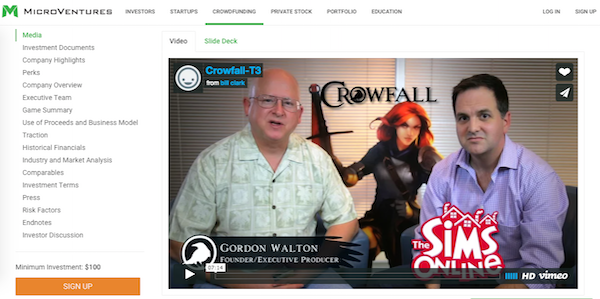

On the MicroVentures website, you’ll also get a lot more information, including items like the company overview, executive team, investment terms, industry and market analysis, risks, and more. Once you sign up for an account with MicroVentures, you’ll be able to invest in the startup.

It’s free to create an account, but you’ll be paid a investment processing fee if you decide to invest in a company. Investment minimums start at $100.

2. Crowdfunding Is Geared Towards Certain Industries

While MicroVentures states that they have raised money for a bunch of different types of companies, their main areas of focus include:

- Internet Technology

- Media and Entertainment

- Software

- Green Technology

- Mobile

- Social

- Gaming

Remember that unlike rewards-based crowdfunding, you’re going to be giving away shares of your company in exchange for investment. You can also decide to offer swag or rewards to your investors. For example, for the people that invest $100 in the ArtCraft Entertainment equity crowdfunding campaign, they’ll also get:

- Access to Beta 2 and all subsequent tests

- Digital copy of Crowfall

- Allows you to post on the Crowfall forums!

- Thanks in the credits as a 2017 Patron

- 2017 Early Backer Avatar Frame

- 2017 Early Backer Forum Badge

- All 2017 Badges and Frames up to Early Backer level

3. You Should Have Product-Market Fit

This is a fancy way of saying that crowdfunding isn’t great for idea-stage companies. You should have some traction, early customers, and be able to show potential investors demand for your product. According to the MicroVentures website, you should also have an experienced team and a unique or innovative concept.

Of course, there are also other factors that MicroVentures will look into when you submit your application. For example, “We believe in accountability to the business (or concept), which is one reason we seek to identify firms whose founders already have invested their own capital in their business.”

While it’s very easy to think about what you need or what you’re looking for, it pays to put yourself in the shoes of a potential investor. Ask yourself, why is this a good investment opportunity? How likely is an investor to get a great ROI on this opportunity? What is the actual growth opportunity for your company?

It must be a win-win opportunity if you want to successfully raise funds.

4. How Long Will It Take To Raise Funds?

If you’re going to be raising funds on Indiegogo/MicroVentures, it’s going to take about six weeks from the application to being fully funded. It will then take about 2 weeks to receive your funds. Remember that under Title III, you can raise upwards of $1 million in a 12 month period. You can raise between $150k – $1 million through Indiegogo/MicroVentures.

After you successfully raise funds, there will be ongoing reporting requirements. You’ll have to update your investors on a quarterly basis. Considering that investors are required by the SEC to hold their investment for at least one year, you should see this as a longterm relationship, until an eventual liquidation event.

Although it’s only going to take six weeks to run an equity crowdfunding campaign, that doesn’t mean that you shouldn’t be preparing for the launch of your campaign far ahead of time. Similar to rewards-based crowdfunding, I recommend that you construct a marketing strategy for your offering. While MicroVentures and Indiegogo will publicize your offering, it doesn’t guarantee you investors.

5. Investor Need-to-Know Checklist

There is no such thing as a sure bet. While investing in the next Facebook has a alot of draw, there are a few things that you should know before you start investing on Indiegogo. Remember that:

- Investments are illiquid. Expect a long investment horizon.

- You’ll get information about the company structure, operations, risks, etc.

- You can ask any questions of Investor Relations Associates.

- There is no guarantee of ROI with startup investments.

- Don’t invest in a company just because others are. Do your own research.

- You must hold your investment for at least one year, but you should plan to until the company has an exit and is either sold or does an IPO. The average exit time for a startup is 7 years.

6. My Thoughts and Predictions

I think we’re going to see more growth in the equity crowdfunding industry. At the time of writing, I think that Indiegogo’s equity crowdfunding solution is a bit clunky. They’re basically saying to just go to the MicroVentures website. I’m sure they’ve worked out some kind of affiliate commission or deal with the company.

It appears as though they are testing out equity crowdfunding and seeing whether or not it makes sense to commit resources and either set up their own platform or acquire MicroVentures. The solution will likely evolve over time.

Given the huge email list that Indiegogo has, we will likely see more demand for these startups on the investor side. Whether or not they become a platform leader depends on how they navigate the media and which startups they manage to attract to the platform.

I know it might seem like they are automatically the 800 pound gorilla leading the charge, but that’s not the case. They are not the leader in personal/charity crowdfunding, despite having a massive platform. GoFundMe is the leader in that arena.

Time will tell how Indiegogo fairs in the equity crowdfunding gold rush. Personally, I’m optimistic about the longterm success of their platform.