CB Insights published an interesting article on August 11th, 2014 about the 443 hardware projects that have raised over $100K on Kickstarter or Indiegogo, as studied by Matthew Witheiler of Flybridge Capital. The CB Insights team expanded on the collected data by examining how many of the 443 companies have raised outside venture capital equity financing.

So far, of the 443 companies, 9.5% have gone on to raise venture capital to the tune of $321 million (total). Also, they discovered that Kickstarter hardware campaigns raised 5x more in investor funding than Indiegogo campaigns.

What’s crazy is that these numbers are only increasing!

“In 2014, investor deal activity to crowdfunded hardware companies is on pace to break 2013’s record with 19 deals already in the first seven months of the year. If the current run-rate continues through the end of the year, 2014 will see over 30 deals.” – Source.

There’s been some speculation in the past that equity crowdfunding might replace angel or venture capital investing for startups. Particularly, the JOBS Act, which when in effect, will allow ordinary americans to invest in startup companies, has been seen as a potential disrupter for well-established financial industries.

Will equity crowdfunding replace angel investing?

First of all, I think that Ryan Caldbeck, the CEO and founder of the equity crowdfunding platform CircleUp did an awesome breakdown of the benefits and drawbacks of equity crowdfunding for angels angels and VCs in his Forbes article.

Who are the Angels:

– Typically invest less than $1 million in startup companies.

– 756,000 angel investors in the U.S. who have made an angel investment in 2013 (source)

– Wealthy individuals that make $200,000 or more in base salary every year, or maintain a net worth of over $1,000,000.

– 5-7.2 million accredidted investors in US that could participate in angel investing (2013).

Their main issues:

– Good deal flow (identifying and getting in touch with quality companies) – See Paul Graham’s essay on how to be an angel investor.

– Lack of investment liquidity.

– Potential for being diluted at later stages in the startup.

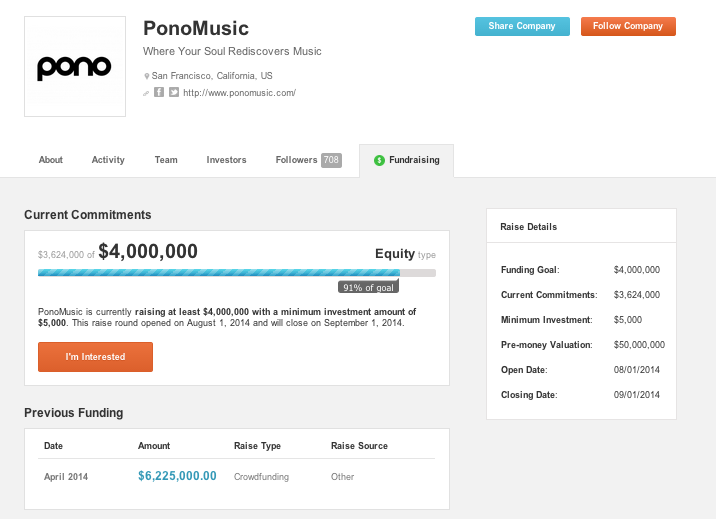

In its current form, equity crowdfunding enables angel investors to find new quality companies and cut deals. Just look at the recent PonoMusic equity crowdfunding offering on CrowdFunder, which has raised $3.6 million from accredited investors at the time of writing.

PonoMusic was first successful on Kickstarter with a whopping $6 million dollar campaign and then turned to equity crowdfunding for further financing. I’m actually kind of surprised they did it through an online portal, rather than just raising the funding using traditional angel investment routes.

According to the press release, “Neil and the team at PonoMusic are excited about democratizing the financing process by giving their Kickstarter backers, and anyone who loves music, the opportunity to now invest and become an owner in PonoMusic.”

I’m not sure how many of the Kickstarter backers are accredited investors, but they’ve certainly gotten traction on CrowdFunder.

If equity crowdfunding enables angel investors, what about rewards-based crowdfunding (Kickstarter, Indiegogo)?

I think it depends on the reason why a company is launching on Kickstarter. One of the most common entrepreneur dilemmas is that the creator doesn’t have enough money to purchase the inventory to keep up with consumer demand. Kickstarter and Indiegogo solve that problem, by helping creators line up the funding ahead of time, which can then be used to manufacture and ship out the product.

The issue with Kickstarter, as we explored in our previous post, is that most campaigns don’t make any profits (5-8%, which can easily be eaten up by miscalculations and hidden fees).

Kickstarter and Indiegogo are great tools to get your product out into the hands of many people, but it’s not such a great tool if you need financing to hire employees, pay for advertising, or get an office location. Most of your funds will go towards financing the production of the rewards you promised.

If an entrepreneur seeks out an angel round to finance the manufacturing of a product (or to buy inventory to meet demand), then yes Kickstarter is a direct competitor. However, if the entrepreneur is seeking out angel investment for other means, like the initial funding needed for him to quit his job and develop the first prototype, then I don’t think Kickstarter is a competitor.

While a successful crowdfunding raise might push up the valuation of the company and make it more expensive for an angel investor to get their foot in the door, it also helps prevent adverse selection by weeding out the bad investments for the Angels, making it less risky for them to invest.

Where does crowdfunding fit into venture capital?

It’s becoming apparent that crowdfunding can be a runway to future venture capital dollars. I don’t think anyone is completely sure how the marketplace will evolve over time, but I’d love to hear what you think in a comment below!

I’m most excited for secondary markets that might develop around the equity crowdfunding that exists now or the JOBS Act‘s proposed measures that allow ordinary americans to invest in startups.

In my opinion, although there is a huge industry around primary markets (IPO), there is even more activity and growth potential around secondary markets (like the stock market). What do you think?