Wow! I’m blown away by the response to my new Amazon ebook, Real Estate Crowdfunding Explained. I’m so happy readers are finding it to be useful! If you decide to check it out, please leave a review.

Fundrise

Fundrise is an online investment platform that gives you the ability to invest directly in commercial real estate. It features both public offerings available to local investors and private offerings available to accredited investors. Fundrise offerings provide shares of equity ownership in specific properties. Fee: 0-3%.

“Developers have used the platform to close investments for more than a dozen projects totaling more than $10 million. Money is currently being raised for four projects, in Austin, Texas; San Francisco; Philadelphia and Brooklyn, N.Y. When those projects close, the total raised through Fundrise could top $12 million” – Washington Post

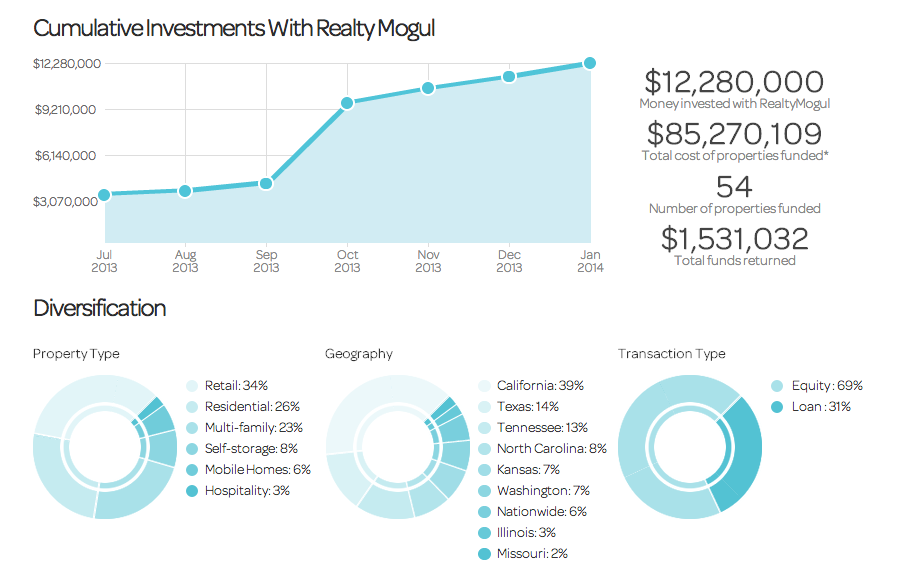

Realty Mogul

“Invest with as little as $5,000.” Realty Mogul is crowdfunding for real estate, a marketplace for accredited investors to pool money online and buy shares of pre-screened real estate investments. The platform offers the opportunity to browse cash-flowing equity investments and real estate loans. Should you chose to invest, there is a fee associated with each investment. The fees depend on the type of investment (loan purchase or equity purchase) and the nature of the transaction.

RealtyShares is an online investment platform that uses crowdfunding to pool investors into private real estate investments. Accredited Investor members have access to extensive information on a variety of investment properties and can invest as little as $5000 into each such property. Some of the real estate asset classes, including: Residential, Commercial, Retail and Mixed-Use.

“There are absolutely no fees to investors for our current first position loan offerings. Rather, we charge the borrower listing and related fees to cover our costs.”

Fun fact: They accept Bitcoins!

CrowdStreet

CrowdStreet is a fundraising platform connecting accredited investors with professionally-managed real estate investments. CrowdStreet features both equity and debt investment opportunities, including multifamily, retail, office, industrial and land opportunities. In addition to traditional direct investments,

“No. There are no investor fees for joining CrowdStreet and accessing the investment opportunities.”

EquityMultiple

Because of current regulations, only accredited investors are able to view and invest in deals posted on EquityMultiple.

When you invest on the platform, you can choose from a variety of asset classes, marketplaces, and geographic locations.

Each property is vetted by the website’s team and goes through a due diligence process. According to the site, the platform accepts about 5% of total applications.

This platform allows you to choose from fixed-income, preferred equity, or equity investments. You can create a portfolio that matches your risk tolerance, capital resources, and desired return.

GroundBreaker

GroundBreaker provides technology for deal sponsors and developers. “Connect with your investor network and grow it organically. When ready, raise capital directly from your investors and close your deals online. Post-closing we give you a toolset so you can manage your investor reporting and distributions.” GroundBreaker charges sponsors a flat monthly fee for the use of its platform. Investors pay nothing.

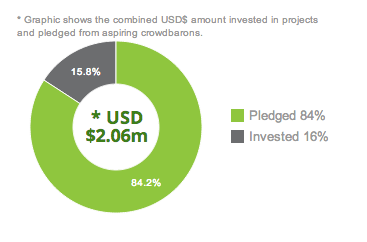

CrowdBaron

Crowdbaron has developed an international platform and accepts members from different countries around the world. Today, interested members from the US can sign up to the newsletter, though currently are not able to invest in any project.

“We are happy to accept members from other countries, including the UK as well as Hong Kong. In these cases, crowdbaron presents projects to members who can demonstrate:

– They are “Professional”, “Sophisticated” investors, according to the Hong Kong SFC, or the UK’s FCA.

We charge a 4% set up fee which is paid only when a project is fully funded. In addition, there is a 1% fee per project year to cover our costs, which is paid only when the property is sold.”

iFunding

“Invest as little as $1,000.” iFunding is a real estate crowdfunding platform that allows individual investors to select and make direct investments in pre-vetted institutional real estate assets.

“For our investors, we select commercial retail and single family residential projects after careful scrutiny only. Using the search tool, users can select the exact type of investment property they are looking for.”

Prodigy Network

Prodigy Network is known for raising $171 million in $20,000 increments for a mixed-use skyscraper development under way in Bogotá, Colombia. Last year, the company raised $24.5 million in equity from 48 investors—who had to put in a minimum of $250,000—to buy another downtown Manhattan building, 84 William St., that it plans to turn into a hotel.

Currently, Prodigy salesmen deal by phone, email or in person with potential investors, but they envision a day when vetted investors will be able to make commitments with the click of a mouse.

The minimum REP investment will vary depending on the project but usually ranges between $100K – $250K. If you are an investor looking to invest in real estate in the United States, you can make your investments by acquiring REPs. REPs are tailored for Non-US investors outside the United States, or Accredited Investors inside the United States. Buying a REP will give you access to large-scale commercial real estate investments that cost upwards of $40 million to buy individually.

Patch of Land

“$5,000 minimum and no investor fees.” Patch of Land facilitates crowdfunding for real estate, also known as online syndication. They allow accredited investors to invest in real estate opportunities online. I’ve included a few types of their investment opportunities below.

Loan Purchase for Residential Fix and Flip: “In this investment, investors pool their money to buy a loan. The loan is tied to a residential property that is being rehabilitated and the property is intended to be sold directly after rehabilitation. The loan is secured by the property until the borrower repays the loan in full. Investors earn monthly interest on their money with a balloon payment at the end. The average hold for a loan like this is 6-9 months. These loans are also sometimes called “First Trust Deed Investments” because the investor’s interest is secured by the property in 1st position.”

Equity Purchase for Commercial Buy and Hold: In this investment, investors pool their money to purchase a piece of a specific commercial property. That property is acquired and managed by a professional investment company with a track record of success. Investors are entitled to a share of the cash-flow from rents as well as a share of the proceeds when the property is eventually sold. The average hold for an investment like this is 3-5 years. These investments are sometimes called “syndications” because the real estate company is syndicating some of the investment from other investors.

Which real estate crowdfunding platforms should be the top 3?

Leave a comment below letting me know which real estate crowdfunding platforms you think should be considered the “top 3.” If I haven’t included a platform on the list, leave a comment below letting me know which website I missed out on.

Further Reading

I recommend checking out our real estate crowdfunding checklist for investors, and if you are an entrepreneur and want to start a real estate crowdfunding platform, be sure to check out these 19 tools to create a crowdfunding site.